Published on 04.11.2020

ASEAN Series: Malaysia

The budget for 2021, approved by the Malaysian government on November 1, provides, like the previous ones, for many tax incentives and the provision of monetary grants to companies. Malaysia's goal is to attract more foreign investors in manufacturing, high technology and high value-added industries.

Manufacturing companies investing between 300 million ringgit and 500 million ringgit (≈60 up to EUR 100 million) in fixed assets are eligible for a corporate income tax rate of 0% for 10 years. Companies investing more than 500 million ringgit (EUR 100 million) can benefit from this incentive for 15 years.

Medium sized companies (SMEs) based in Malaysia, with a maximum paid-in capital of RM 2.5 million (≈500T EUR), which are not subsidiaries of international groups, can apply for a 17% reduction of the corporate income tax rate on profits up to RM 500,000, the tax rate on the remaining profit remains at 24%. Training measures for employees can be deducted twice from taxes in the long term.

In addition to the tax incentives, government grants are available for the development of the digital economy. The aim is to advance the industry by introducing new technologies, training local workers and developing new sub-sectors of the electronics and electrical industry and the automation industry.

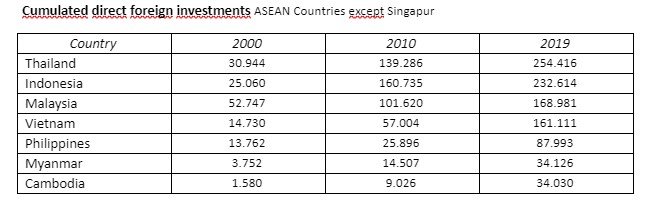

As a developing country, Malaysia is aware that its economic development is heavily dependent on FDI. In view of the ongoing trade tensions between the US and China, Malaysia is trying to position itself as a preferred destination for foreign direct investment in the ASEAN region through tax breaks. Talks with foreign investors are very much welcomed by the Malaysian government authorities. Governmental advisory bodies have been established to accelerate investment by European and Chinese companies seeking to relocate or diversify their business activities from China to Malaysia.

Investments made (FDIs) are generally accompanied by the Malaysian Investment and Development Authority (MIDA), which makes basic strategic recommendations and advises on implementation. However, the authority also reviews upcoming investments and restricts them if necessary if they are to be made in the sectors of energy supply, water supply, financial services, insurance (Takaful), oil industry, maritime transport services, food wholesale, education or security agencies.

In recent years, foreign investment has varied between EUR 8 and 10 billion p.a., twice as much as in the Philippines and half as much as in Indonesia, with Indonesia having 8 times the population and land area of Malaysia.

More than 70% of the FDIs flow into the economic centers Kuala Lumpur, Sabah, Selangor, Johor, and Penang.