Veröffentlicht in China News am 14.08.2019

China News: China's Economic Outlook in Six Charts

China’s economic growth is moderating and is projected to be 6.2 percent in 2019. In its latest annual assessment of China’s economy, the IMF found the quality of growth had improved in three ways in 2018. First, the pace of debt accumulation had slowed. Second, the financial system is better regulated and supervised. Finally, the current account surplus is no longer excessive. But trade tensions cloud the outlook, and reforms need to deepen if this progress is to be continued.

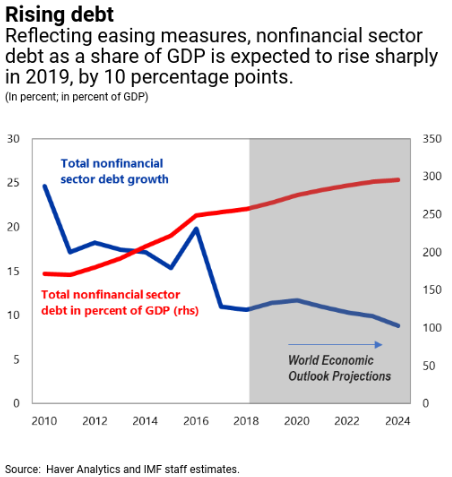

After slowing last year, debt accumulation accelerated in the first quarter of 2019. By avoiding further stimulus measures, China would help check the pace of debt accumulation. However, some modest fiscal stimulus would be appropriate to offset the negative impact to the economy of higher U.S. tariffs on Chinese goods.

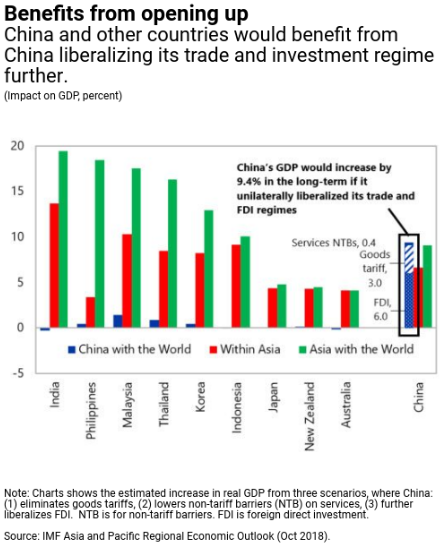

Accelerate opening up. Despite gradual opening to foreign trade and investment, China remains less open than other G20 emerging market economies in services and foreign direct investment. An agreement with the United States has the potential to support the global trading system, and could also benefit China through further opening up its trade and foreign investment regime and bring about other structural reforms that enhance competition.

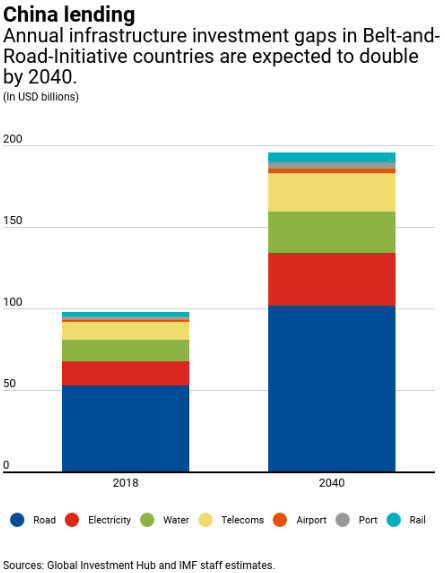

Strengthen external lending framework. China’s lending outside the country, such as through the Belt and Road Initiative, has the potential to bring significant benefits to partner countries. A lending framework that promotes greater coordination, cooperation, and transparency would help maximize the benefits of China’s external lending for partner countries and for China itself, for example by directing financing to much-needed infrastructure projects, strengthening bilateral trade, and deepening global value chains.

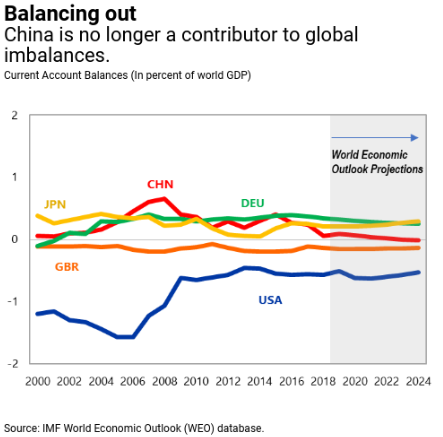

Taking measures to help ensure the current account surplus remains in check. China made progress in reducing external imbalances over several years, and its exchange rate in 2018 was broadly in line with fundamentals. However, continued efforts are needed to address the distortions that encourage excessive household savings, as well as further boosting consumption. This will also increase the welfare of Chinese citizens, who spend less on consumption than those in other similar income-level countries.

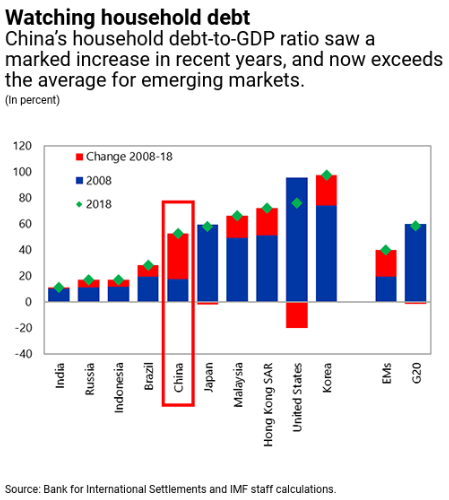

Addressing vulnerabilities. China should stay the course on implementing the planned financial regulatory reforms, raise capital in smaller banks, and control the rapid growth of household debt. The debt-service-to-income limit (currently 55 percent) should be tightened to international norms of 30–50 percent, applied to all debt obligations including those from nonbanks, and used more actively to enhance the effectiveness of loan-to-value limits, for example, by restricting the use of unsecured loans for mortgage down payments.

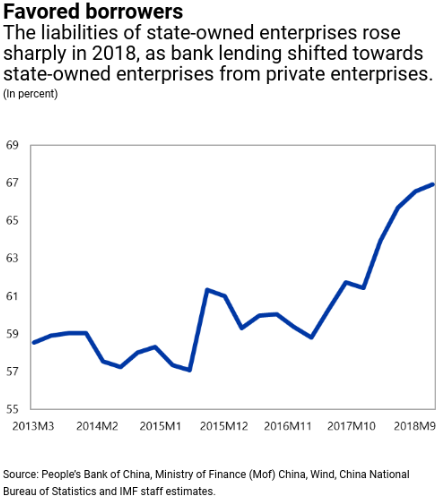

Increasing the role of the market in the economy. By opening up more sectors to private and foreign competition and reducing the share of credit going to state-owned enterprises, China could significantly lift productivity and potential growth. Removing the implicit guarantees and hardening the budget constraints for state-owned enterprises would improve credit allocation and limit their advantage in accessing credit.

Source: imf.org/en/News/Articles/2019/08/09/na080919-chinas-economic-outlook-in-six-charts