Veröffentlicht in ASEAN News am 16.11.2020

ASEAN Series: Singapore

When the state of Singapore was expelled from the Malaysian Federation in 1965, the former English crown colony was confronted with major problems such as mass unemployment, shortage of housing, arable land and raw materials. It is mainly thanks to the Dutch economist Albert Winsemius, who in cooperation with the state government, brought about Singapore's steep economic rise.

Today, Singapore is one of Asia's most important financial centers and trans-shipment centers for goods, as well as a member of the Commonwealth of Nations and the Association of Southeast Asian Nations (ASEAN). As a country with a decidedly liberal economic policy, excellent infrastructure and low taxes, it attracts many foreign investments and a skilled workforce, which further drives the innovative and dynamic economy.

Infrastructure

Singapore is geographically located at the southern tip of the Malay Peninsula. To the west of the country lies the Strait of Malacca, one of the busiest waterways in the world. More than 25% of the world's cargo handled by ocean shipping passes through this strait. It is of enormous importance for trade between Europe and Asia.

Already the British recognized Singapore's favorable location and established a trading post in 1819. Today, 200 years later, the relevance of the port has further increased. The port handles one-fifth of the world's container trade and half of the world's crude oil trade, and there are logistics connections to 600 other ports in 125 countries. In terms of container volume in tons, the port of Singapore is the 2nd largest in the world.

Singapore's Changi airport is also one of the most important logistics hubs in Asia. For several years in a row, it was voted the best airport in the world by the Skytrax rating agency and regularly flies to 400 different destinations.

As far as infrastructure is concerned, Singapore has managed to establish a reliable water and electricity supply without having much land or resources. Tap water is one of the few in Asia that is drinkable, and the cost of electricity is 13 cents/kwh, which is significantly lower than in Germany.

As a regional financial center, the country offers a dense network of banks that cover all services and are less state-regulated than those in Germany and the EU.

Company foundation

Incorporating a company is as simple as in Hong Kong; to form a limited liability company you need a resident director, a company secretary and 1 to 50 shareholders. The registered capital must be at least SGD 1, and the incorporation usually takes 2 to 4 weeks.

The preferred language in business, administration and school is English. High Chinese (Mandarin) is also widely spoken and supported by the government. In addition to these predominant languages, many others are also spoken by minorities. This is due to the fact that, historically, people from different countries and cultures live in Singapore. Behavior and attitudes of every Singaporean are fundamentally influenced by their origin. Although this can lead to misunderstandings in business transactions, social harmony and diversity play a decisive role in the success of Singapore.

In general, Germans can enter Singapore without a visa, a 90-day residence permit is issued at the airport, and this permit can be renewed each time they leave and re-enter the country. Foreign investors and employees who have worked in Singapore for at least 6 months as well as students can apply for an unlimited residence permit (Permanent Resident). The Singaporean citizenship is usually granted to foreigners who have lived in Singapore for 2 years, have a fixed income and apply accordingly. All other citizenships have to be given up in this case.

Crime is not a problem in Singapore, unlike some other Asian countries, it is one of the safest countries in the world and regularly ranks first in international rankings for prevention of corruption. This solid state of public order and justice has its price, however; the government is described by many organizations as authoritarian. Media and freedom of expression are censored and restricted by the government, and some civil rights are only partially granted. The powerful "People's Action Party" has ruled virtually alone since the founding of the state in 1965. There are stiff penalties for drug possession, vandalism and littering the public with garbage.

Currency and taxes

The national currency, the Singapore Dollar (SGD), has been a stable currency for a long time and is constantly appreciating in relation to the USD, for example. Unlike the Chinese Renminbi, the SGD is freely tradeable and convertible.

In addition to its role as a financial center and transit port, the country also stands out for its low taxes.

The corporate income tax rate is 17%, there are no more major tax incentives as there were a few decades ago, only profits below SGD 300,000 p.a. are - under certain conditions - taxed at 8.5%.

In general, a territorial taxation principle applies; companies and individuals are mainly taxed on income generated in Singapore. Foreign income (branch profits, dividends, income from services, etc.) is not taxed if it has already been calculated with at least 15% in the country of origin.

Although the concept of territorial tax may seem simple at first glance, its application in practice can often be complex and controversial. No universal rule can apply to every scenario. Whether profits arise in Singapore or originate in Singapore depends on the nature of the profits and the transactions that give rise to those profits.

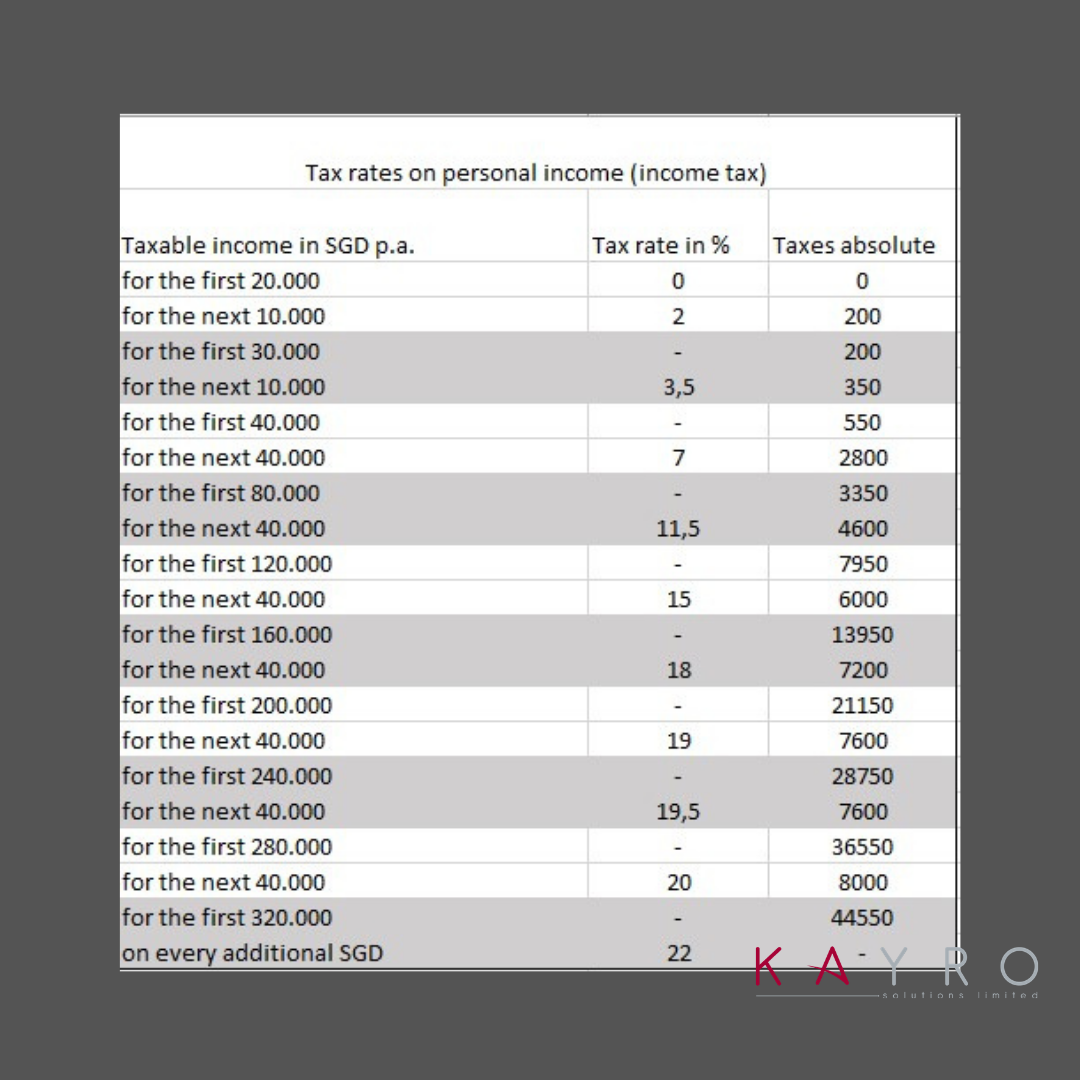

The tax rates on personal income are as follows:

The value added tax (VAT) has been 7% since 1994. Withholding tax on interest, royalties, rents, management fees paid to non-residents (individuals or companies) is subject to a 10% tax rate in Singapore.

Capital gains, gift, wealth and inheritance tax is 0.

A difference to Hong Kong is the regulation that all employees must be covered by social security. Depending on age and length of stay in Singapore, the employee must transfer 5 to 20% of gross salary to the state pension fund (CPF), the employer 7-17%. This is primarily used to pay into the pension scheme, but it also automatically provides health insurance.

Although the tax burden is somewhat higher than in Hong Kong, the state provides comprehensive services in modern hospitals and social benefits for poorer families. When a child is born, for example, the family of a citizen or permanent resident is supported with up to SGD 166,000.

Double taxation and free trade agreements

A comprehensive double taxation agreement between Germany and Singapore has been in place since the beginning of 2007. The main purpose of this agreement is to prevent the double levying of income tax, corporation tax, wealth tax and trade tax.

Furthermore, the "EU-Singapore Free Trade Agreement" (EUSFTA) between the EU and Singapore came into force in 2019. Since then, Singapore no longer levies any customs duties on the import of goods from the EU. In return, the Europeans treat 80% of all Singaporean goods such as electronics, petrochemicals and pharmaceuticals as duty-free. In addition, technical regulations, norms and conformity procedures are based on international standards to simplify the flow of goods and avoid multiple verification of norms. This free trade agreement is also accompanied by improved protection of intellectual property rights and market access in public tenders and for services.

In addition to this agreement, Singapore is also part of the recently signed free trade agreement "RCEP". It is expected to eliminate virtually all tariffs between the 15 signatory countries over the next decades: Brunei, Indonesia, Cambodia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam, China, Japan, South Korea, Australia. The participating countries, with a world population of 30%, already generate about 28% of the world's GDP, and the trend of economic performance is strongly increasing. It can be assumed that in the medium term this economic block will become the largest domestic market in the world.

In summary, it can be said that Singapore is a highly developed country which has achieved wealth primarily through its port, banks and the oil and electronics industry.

Supported by the agreements with the ASEAN (+6) region, other countries like Germany, low taxes and foreign investment, the country will remain an important location for the Asian economy in the future.

Compared to the surrounding countries, Singapore boasts lower language barriers, a more qualified workforce, a more efficient administration and better logistical connections.

Although the country is not suitable for the establishment of labor-intensive production due to the high labor costs, it is all the more suitable to establish the headquarters for activities in the ASEAN region here. Many companies have already used the advantages of Singapore to coordinate the production and/or sales of products in Asia.