Veröffentlicht in ASEAN News am 29.10.2020

ASEAN Series: Indonesia

As a result of the trade war between the USA and China, which has been ongoing since the beginning of 2018, rising production costs, a volatile money market and long-standing economic restrictions, more and more companies are deciding to relocate all or part of their production to southwest Asia - to the ASEAN region.

This week we will focus on Indonesia.

Indonesia has introduced generous tax incentives for certain companies in 2019.

How far-reaching are they and what does this mean for investors?

In June 2019, the Indonesian government issued Government Ordinance GR 45/2019, which provides a range of tax incentives for companies investing in labor-intensive industries, training programs and research and development (R&D).

The incentives are intended to promote foreign direct investment (FDI), expand the number of qualified workers, and develop local industry and infrastructure.

Investments in labor-intensive industries

Companies that invest or expand in labor-intensive or pioneering industries can enjoy a net income reduction of 60 percent of their total investment in fixed assets, including all land used for business activities.

The Ministry of Industry defines a labor-intensive industry as an industry that employs at least 200 workers and whose labor costs do not exceed 15 percent of production costs, while pioneer industry is defined as an industry that has economic consequences with added value for the surrounding areas.

Foreign investors can use these new incentives - together with the country's production base, competitive labor costs and large consumer market - to establish bases in Indonesia for key sectors such as textiles and clothing, raw materials and services.

Major foreign direct investment in labor-intensive industries will create jobs and help improve the existing infrastructure and business ecosystem - companies investing now can also benefit from a first mover advantage.

Investment in training activities

Investors who want to start education programs or training activities for the development of employees based on "specific skills" can receive a gross income reduction of up to 200% of the total costs incurred. The regulation defines certain competencies as the development of employees that can meet the labor needs of national industries and companies.

This incentive is particularly advantageous for foreign companies that need or want to build up a pool of qualified workers or improve the efficiency of their operations. In the meantime, companies already established in the country and providing regular training for local workers will benefit, especially those in high-end manufacturing, such as automotive and electronics.

This stimulus is likely to increase the demand for vocational training, providing further downstream opportunities for investors. Language courses, for example, are in high demand as students and professionals seek to acquire the language skills needed to compete in today's global economy.

In addition, the hospitality and IT sectors are also becoming increasingly popular, as many secondary schools do not have the skills to prepare students for the job market. The country also has an urgent need for responsible teachers, another opportunity for foreign investment in vocational training.

Research & Development (R&D)

Taxpayers who participate in R&D initiatives can receive a 300% tax relief in the form of a gross income reduction on the total costs incurred. To qualify for this, the taxpayer must conduct research and development that the government believes (i.e., individual assessment) will benefit the national economy, new industries and technologies or the transfer of foreign technology to local companies.

This incentive is designed to encourage more companies to generate innovation and shift to more high-tech industries and products, be it the development of specialized fabric equipment or new agricultural cultivation methods. This type of innovation is a necessity for expanding industries.

Indonesia as an investment target

The considerable political efforts of recent years are reflected in most statistics, for example Indonesia ranked 40th in the IMD "World Competitiveness Ranking 2019" (DE=17), which assesses the national competitive environment. In the "Ease of Doing Business 2019" ranking (i.e. the simplicity of doing business), Indonesia was upgraded from 91st to 73rd place.

The above-mentioned government decree GR45/2019 pursues ambitious goals. Despite China's position as a leading manufacturer of goods, the situation has deteriorated due to the trade war and the deteriorating Chinese economy, many multinational companies have been forced to relocate all or part of their operations to markets in Southeast Asia, such as Indonesia.

This "China plus one" approach enables foreign companies not only in China but globally to diversify their production strategies and protect themselves against macroeconomic and political risks. Indonesia has become a leading production location in the ASEAN region and, due to low operating costs, has become an investment target for companies applying this strategy.

Compared to China, the free flow of capital is the main advantage, the entrepreneurs are enabled to trade the Indonesian Rupiah freely, in general the import and export of foreign exchange is unlimited, profits can be transferred abroad without restrictions.

Since 2005 the protection against arbitrary expropriation and the equal treatment of Indonesian and German capital investments is guaranteed by a bilateral state treaty.

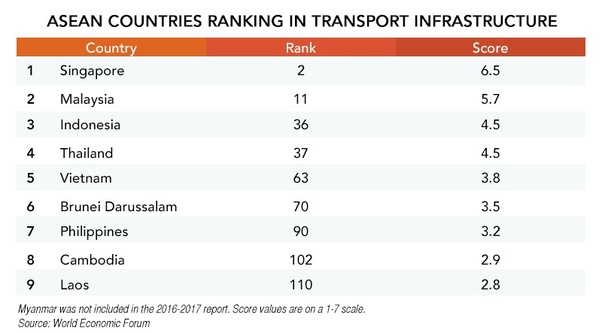

However, a number of challenges remain if Indonesia is to take full advantage of the changing trade and investment environment in Asia. While the country is developing its knowledge-based economy and moving up the value chain, the country's growing industries are facing not only technological and infrastructural challenges, but also a shortage of qualified workers.

Economic regulations such as Regulation GR45/2019 will aim to attract significant foreign and domestic private investment to address these problems and increase the country's competitiveness on the global stage.